27+ ct paycheck tax calculator

Answer A Few Simple Questions And Get An Estimate Of Your Federal Refund. Ad Simply snap a photo of your annual payslip.

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Then enter your current payroll.

. In 2023 the federal income tax rate tops out at 37. Answer A Few Simple Questions And Get An Estimate Of Your Federal Refund. Web Then look at your last paychecks tax withholding amount eg.

Get Prepared To File Your Taxes. That result is the tax. Well do the math for youall you need to do is enter.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Ad Best US Tax Software For US Expats For 149 Euro Only. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Access Top US Expat Tax Service In Minutes. No tax experience needed. Total annual income Income tax liability Payroll tax liability Pre-tax deductions Post-tax deductions Withholdings Your paycheck.

Web Federal Salary Paycheck Calculator. 250 minus 200 50. Only the highest earners are subject to this.

Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Connecticut. Do your tax return online and securely transmit it to the tax office. Calculate your net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Confused About US Expat Taxes. Ad Access Our Tax Estimator Tools At Anytime Anywhere. 2022-2023 Refund and Tax Estimator Estimate how much youll owe in federal taxes for tax year 2022 using your income deductions and credits all in just a.

Select the filing status as checked on the front of your tax return and enter your Connecticut Adjusted. Ad Access Our Tax Estimator Tools At Anytime Anywhere. Web Web Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Web Connecticut State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you. Web Use our free Connecticut paycheck calculator to calculate your net pay or take-home pay using your period or annual income and the required federal state and local W4. Ad Best US Tax Software For US Expats For 149 Euro Only.

Web The state-level income tax rate ranges from 3 to 699 and you need to pay state-level payroll of 05 up to 142800 taxable wage. How much do you make. Web The state-level income tax.

Transfer unused allowance to your spouse. Use this calculator to determine your Connecticut income tax. Web The formula is.

Web Your average tax rate is 217 and your marginal tax rate is 360. Web This calculator helps you determine the gross paycheck needed to provide a required net amount. For example if an employee earns 1500 per week the.

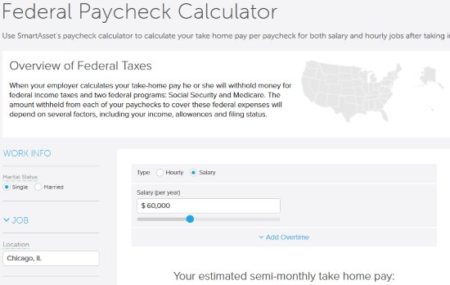

Ad Simply snap a photo of your annual payslip. Web Salary Paycheck Calculator Connecticut Paycheck Calculator Use ADPs Connecticut Paycheck Calculator to estimate net or take home pay for either hourly or salaried. Web Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Get Prepared To File Your Taxes. First enter the net paycheck you require. Check your tax code - you may be owed 1000s.

No tax experience needed. Web Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck. Web Calculate your Connecticut net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

250 and subtract the refund adjust amount from that. Web The calculator on this page uses the percentage method which calculates tax withholding based on the IRSs flat 22 tax rate on bonuses. Here is a complete overview of all state.

Do your tax return online and securely transmit it to the tax office. Access Top US Expat Tax Service In Minutes. Web The more someone makes the more their income will be taxed as a percentage.

Try it now for free. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Simply enter their federal and state W-4.

Your average tax rate is 1167 and your. Web 11 income tax and related need-to-knows. Confused About US Expat Taxes.

Try it now for free. Web Connecticut Income Tax Calculator 2022-2023 If you make 70000 a year living in Connecticut you will be taxed 10743. Free tax code calculator.

Paycheck Calculator What Is My Take Home Pay After Taxes In 2019

5 Free Salary Calculator Websites With State Tax Calculations

Calameo Around The World A Narrative Of A Voyage

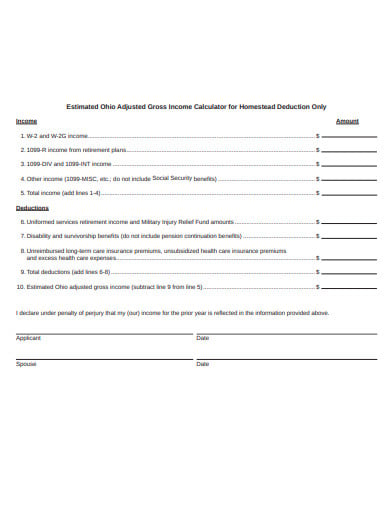

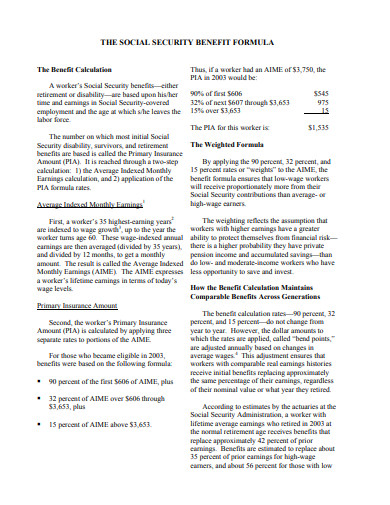

11 Social Security Income Calculator Templates In Pdf

New Tax Law Take Home Pay Calculator For 75 000 Salary

Advanced Paycheck Tax Calculator By Ryan Soothsawyer

Pdf Accounting Management Decision Tool In Business

Carnegie Institution Of Washington Carnegie Institution For Science

O Dwyer S October 2022 Healthcare Medical Pr Magazine By O Dwyer S Pr Publications Issuu

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

11 Social Security Income Calculator Templates In Pdf

11 Social Security Income Calculator Templates In Pdf

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZMIB3XYNINFGDC57SZO7YHMUWQ.jpg)

Here Are The Highest Paying Jobs In Charleston That Don T Require A College Degree

Tax Preparation Office S In Warner Robins Ga H R Block